Amazon VAT Changes, 3D Models, and Coupon Updates for Sellers – 3fin Weekly Briefing #16

How Amazon's VAT Changes in Europe Could Lead to Temporary Cash Flow Gaps for Sellers

In this week’s edition, we cover important changes to Amazon coupon durations, the exciting new ability for brand-registered sellers to upload 3D models, and Amazon’s latest “Five Box Rule” for inbound shipments. We also dive deep into the impact of Amazon Europe’s VAT changes on UK and EU sellers, and how to adjust your business accordingly. Finally, our Pro Tip focuses on how using video in your Amazon listings can significantly boost your conversion rates.

News of the Week

Changes to Coupon Durations: Effective September 5, 2024, the maximum durations for three types of Amazon coupons will be adjusted:

Standard Coupons: Reduced to 30 days

Reorder Coupons: Extended to 180 days

Subscribe & Save Coupons: Expanded to 365 days

3D Model Uploads Now Available: Brand-registered sellers can now upload 3D models to product listings, allowing customers to view products from every angle. This feature offers an immersive shopping experience and has been shown to increase conversions by providing more product detail and clarity.

Amazon’s New “Five Box Rule”: To avoid the inbound placement service fee, Amazon has introduced a new requirement: your shipments must include at least five identical cartons or pallets per item. Each carton or pallet must contain the same quantity of the item and consistent item mix. This update is aimed at optimizing inbound logistics and reducing costs for compliant sellers.

New Amazon RFID Seal Requirement for Full Truckload Shipments: Starting September 12, 2024, full truckload shipments (over 14 pallets) will require Amazon-approved RFID seals at the pickup point. Sellers must purchase these seals via a specific website or Amazon Business at a premium. For LTL and small parcel shipments, sealing will be handled by the carrier at the consolidation terminal.

Deepdive: Amazon Europe Now Charges VAT on Seller Fees – Impact on UK and EU Sellers

As of August 1, 2024, Amazon sellers from nine European countries will now have to pay VAT on Amazon’s services, including fulfillment and referral fees. This change is a result of Amazon switching the legal entity responsible for seller accounts. Let’s dive into what this means for your business and how you can prepare.

Key Takeaways:

From August 2024, European Amazon sellers will be charged local VAT (typically around 20%) on all Amazon seller and FBA fees.

Cash flow will be immediately impacted as cash expenses related to Amazon fees will increase by the VAT amount (roughly 20%). This makes cash flow planning more crucial than ever.

While this VAT can generally be reclaimed from your government, sellers need to adjust their financial planning to reflect these changes.

What Changed on August 1, 2024?

According to Amazon, “Effective August 1, 2024, Selling on Amazon, Fulfillment by Amazon, and all other services previously supplied by Amazon Services Europe S.à r.l. (ASE) will now be supplied by Amazon EU S.à r.l. (AEU).”

While this may sound like a simple legal switch, the ramifications for sellers are significant:

Before August 1: Sellers in Europe dealt with Amazon Services Europe S.à r.l. (ASE), based in Luxembourg, meaning services were reverse-charged for VAT purposes. In other words, sellers didn’t have to pay Amazon for VAT directly.

After August 1: Seller services are now provided by Amazon EU S.à r.l. (AEU), which has branches in nine European countries. As a result, Amazon now issues invoices from the local AEU branch in your country, and these invoices are subject to local VAT regulations.

What Does This Mean for European Amazon Sellers?

If your business is based in one of the nine countries where Amazon EU S.à r.l. (AEU) has a branch—the United Kingdom, Germany, France, Italy, Spain, the Netherlands, Belgium, Poland, and Sweden—you will now see local VAT applied to Amazon’s invoicing.

For sellers in these countries, this means increased VAT charges on Amazon fees. For instance, if you're based in the UK, where VAT is 20%, this amount will be added to your Amazon fees (such as FBA fees, selling fees, and storage fees). The VAT will be deducted directly from your payouts, impacting your immediate cash flow.

VAT Recovery: Reclaiming Your Money

Sellers will be able to reclaim the VAT as part of their VAT return process. While this ensures you won’t be out-of-pocket permanently, the timing of the refund depends on your specific VAT filing period. Until that refund is received, you’ll need to manage the temporary cash flow impact.

If your business is not based in one of the nine listed countries, invoices will continue to be issued by AEU’s Luxembourg office, and the VAT calculation method will remain unchanged.

Impact on Your Accounting

Before this change, most sellers applied a Reverse Charge VAT rate to their Amazon fees, except for UK sellers who were already charged 20% VAT on sponsored ads. Starting August 1, 2024, seller fees and FBA fees will be taxable at your country’s applicable VAT rate. To ensure compliance, you’ll need to update the tax rates in your bookkeeping system to correctly reclaim VAT on your returns.

How Will This Affect Cash Flow?

If you have a VAT number, you should be able to reclaim the VAT you pay on Amazon fees. However, until you file your VAT return, you will face a temporary cash flow shortfall. This is especially impactful for businesses operating with slim margins, as many European countries have VAT rates around 20%. Let’s look at a simple example (assuming no extra costs):

Example for a UK-Based Seller (20% VAT):

Monthly sales: GBP 100k

Monthly amazon costs: GBP 55K

Amazon Fees (FBA, selling fees, storage fees): GBP 40k (40% of sales)

Advertising costs (PPC): GBP 15k (15% of sales)

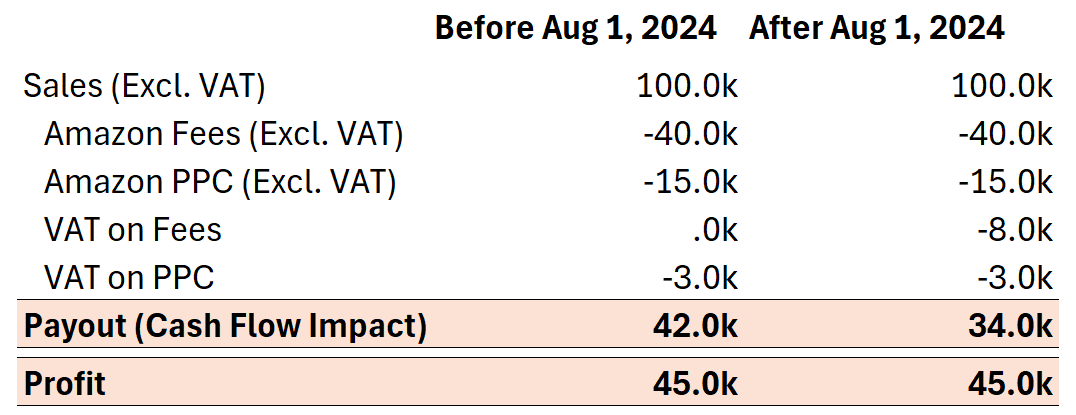

The table below illustrates the impact on both your Amazon payout (cash flow) and overall profit.

Before August 1st:

Profit: GBP 45k

Cash flow: GBP 42k (after GBP 3k VAT on PPC fees)

After August 1st:

Profit: GBP 45k (Profit remains the same as VAT does not impact the Income Statement)

Cash flow: GBP 34k (due to an additional GBP 8k VAT on Amazon fees)

In this example, a 20% VAT on Amazon services reduces cash flow by approximately 20%, leaving you with a shortfall until you can reclaim the VAT. Depending on the country, it may take months to get this VAT refund, so it’s essential to plan your cash flow accordingly.

How Does This VAT Change Impact Your 3fin Profit & Loss (P&L)?

Prior to August 1, 2024, 3fin displayed your P&L net of VAT, as it should. However, since the VAT is now included on Amazon fees and PPC charges, your P&L will temporarily show VAT-inclusive costs. This is because Amazon’s APIs currently don’t separate the fee amount from the VAT amount. We are actively working on a fix to return the P&L display to a VAT-excluded format.

Tip of the Week: Boost Conversions with Video in Your Amazon Listings

Did you know that Amazon listings with videos have a ~34% higher conversion rate than those with just images? Video is a powerful tool to showcase your product’s benefits, usage, and features from every angle. It’s also the perfect spot to feature user-generated content (UGC) for added credibility.

Make sure to:

Keep your video under 5GB in .mp4 or .mov format.

Design a compelling thumbnail, similar to YouTube.

Take advantage of Amazon’s free Ads Creative tool to create videos.

Don’t forget—you can also repurpose these videos on social media or in Sponsored Brand Video ads for more exposure!

We hope you’ve enjoyed this week’s briefing. If you wish to learn more about 3fin, you can book a call or try it for free.

If you enjoyed this newsletter, don’t forget to subscribe and share it with your network!